Managing personal finances can be a daunting task, especially if you are new to budgeting. However, with the start of a new year, it’s an excellent time to take control of your finances and start budgeting. Budgeting helps you keep track of your income and expenses, enabling you to manage your finances more efficiently. One of the best ways to create a budget is by using a budget spreadsheet template. These templates are easy to use and can save you time and effort by automating calculations and providing pre-built categories for tracking your finances.

As we enter a new year, one of the best things you can do for your finances is to start budgeting. However, the process of creating a budget can be intimidating and time-consuming. Luckily, there are budget spreadsheet templates available that can help you get started quickly and easily.

Top 5 budget spreadsheet

In this article, we’ll be sharing the top 5 budget spreadsheet templates to use in 2023. Whether you’re new to budgeting or a seasoned pro, these templates are sure to help you keep your finances on track.

1. Personal Monthly Budget

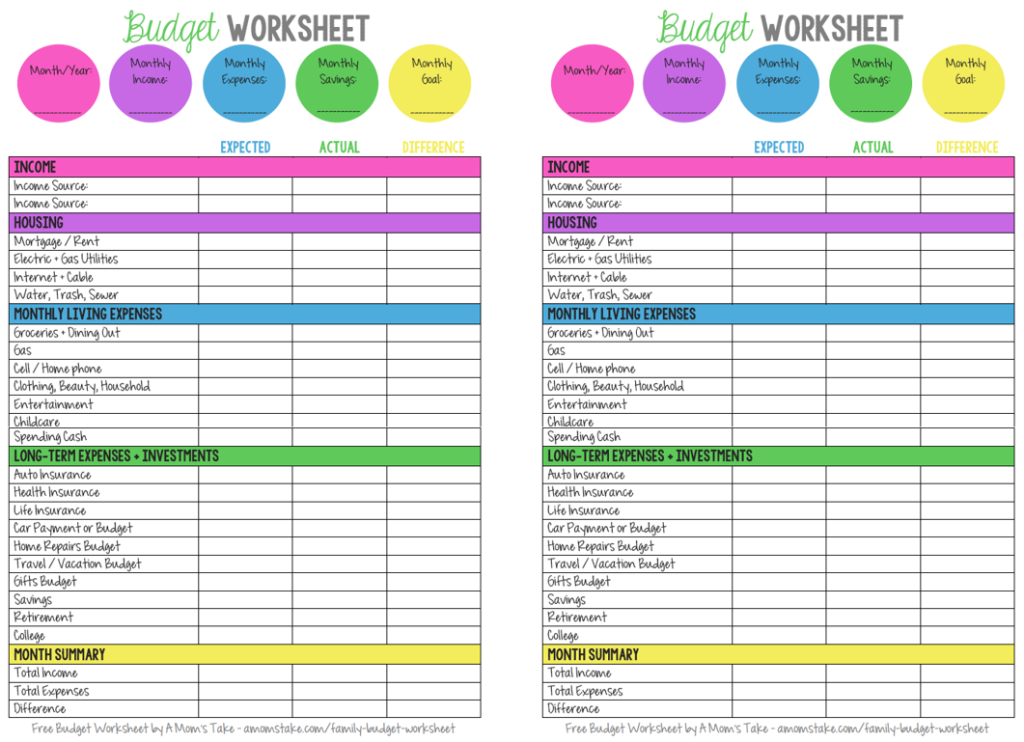

The Personal Monthly Budget spreadsheet template is a simple and effective tool to manage your finances. It’s an ideal template for beginners who are new to budgeting and want to keep track of their income and expenses. The template allows you to input your monthly income, expenses, and savings goals, making it easy to monitor your finances on a monthly basis.

With this template, you can track your spending in different categories such as housing, transportation, groceries, entertainment, and more. It also includes a section to input any additional income, such as bonuses or side hustles. The template automatically calculates your net income and expenses, giving you a clear picture of your cash flow. You can then use this information to make adjustments and prioritize your spending to reach your financial goals.

The Personal Monthly Budget template is highly customizable, allowing you to add or remove categories to suit your specific needs. You can also set up alerts to notify you when you exceed your budget in a particular category. This template is an excellent starting point for anyone who wants to take control of their finances and develop healthy spending habits.

Also Read: How to Improve Credit Score to Get a Loan?

2. Yearly Budget

The Yearly Budget spreadsheet template is an ideal tool for those who want to plan their finances for the entire year. It’s perfect for those who have irregular income or expenses, such as freelancers or business owners. This template allows you to input your expected income and expenses for the year, making it easy to plan for future expenses.

The template includes categories such as housing, utilities, transportation, food, entertainment, and more. You can also input your savings goals and track your progress throughout the year. The Yearly Budget template also includes a section for irregular expenses, such as taxes or insurance payments, allowing you to plan for these expenses ahead of time.

By using the Yearly Budget template, you can ensure that you have enough funds to cover all your expenses for the year. It also allows you to make adjustments throughout the year as your income or expenses change. This template is an excellent tool for anyone who wants to take a proactive approach to their finances and plan for their future financial goals.

3. Debt Reduction

The Debt Reduction spreadsheet template is an excellent tool for those who want to get out of debt and become debt-free. It helps you to create a debt payoff plan and track your progress towards paying off your debts. The template allows you to input your debts, including credit cards, loans, and other types of debt, and their interest rates and minimum payments.

The Debt Reduction template uses the snowball method to help you pay off your debts. This method involves focusing on paying off the smallest debt first while making minimum payments on the other debts. Once the smallest debt is paid off, you move on to the next smallest debt, and so on until all debts are paid off. This approach can help you build momentum and motivate you to continue paying off your debts.

The Debt Reduction template also includes a debt payoff schedule, which shows you how long it will take to pay off each debt and how much interest you will pay over time. You can use this information to make adjustments to your debt payoff plan and see the impact of paying more than the minimum payments.

By using the Debt Reduction template, you can develop a debt payoff plan and track your progress towards becoming debt-free. It’s an excellent tool for those who want to take control of their finances and reduce their financial stress.

4. Retirement Savings

The Retirement Savings spreadsheet template is an essential tool for those who want to plan for their retirement. It allows you to calculate how much you need to save each month to reach your retirement goals. The template takes into account your current age, retirement age, expected retirement income, and other factors to provide you with a personalized savings plan.

With the Retirement Savings template, you can input your retirement income sources, such as social security, pensions, and investments, and estimate your expected expenses during retirement. The template then calculates how much you need to save each month to achieve your retirement goals.

The Retirement Savings template also allows you to adjust different variables, such as retirement age or expected rate of return on investments, to see how they affect your retirement savings plan. You can also compare different scenarios, such as retiring earlier or later, to see how they impact your retirement savings.

By using the Retirement Savings template, you can plan for your retirement and ensure that you have enough funds to maintain your lifestyle during retirement. It’s an excellent tool for anyone who wants to take control of their retirement savings and plan for a comfortable retirement.

5. College Savings

The College Savings spreadsheet template is an excellent tool for parents who want to save for their children’s college education. It allows you to estimate the cost of college and create a savings plan to achieve your college savings goals. The template takes into account factors such as current age, the number of years until college, and expected college costs to provide you with a personalized savings plan.

With the College Savings template, you can input the estimated cost of tuition, room and board, books, and other expenses. The template then calculates how much you need to save each month to achieve your college savings goals. You can also adjust variables such as the expected rate of return on investments to see how they impact your savings plan.

The College Savings template also includes a section to track your progress towards your savings goals. You can input your contributions and see how they impact your overall savings. The template also allows you to compare different savings scenarios, such as contributing more or less each month, to see how they affect your college savings plan.

By using the College Savings template, you can plan for your children’s college education and ensure that you have enough funds to cover their expenses. It’s an excellent tool for parents who want to take control of their finances and plan for their children’s future education expenses.

Conclusion

budgeting is a crucial tool for managing personal finances and achieving financial goals. By using the right budget spreadsheet template, individuals and families can simplify the budgeting process and gain valuable insights into their financial situation.

We have explored the top 10 budget spreadsheet templates to use in 2023, including monthly and yearly budgets, debt reduction, retirement savings, and college savings templates. Each template is designed to provide a structured approach to budgeting and help individuals achieve their financial goals.

By using these templates, individuals can take control of their finances and plan for their financial future. Whether it’s getting out of debt, saving for retirement, or planning for their children’s education, these templates provide the necessary tools to achieve these goals.

In conclusion, the right budget spreadsheet template can make a significant difference in one’s financial well-being. By choosing the appropriate template and using it consistently, individuals can achieve financial success and improve their quality of life.